Property > Expenses

Household Bills

This article breaks down the most common household bills, so you can be aware of some of the payments you might need to make.

In This Article

Mortgage Repayments

Overview

- Typical Frequency

Monthly

- Amount

Your monthly repayment will depend on several factors such as the size of the mortgage, interest rate and length of the mortgage term. To give you a general idea, Santander found that in 2018 the average monthly repayment for first-time buyers was £723, based on an interest rate of 2.48%.

There are two main mortgage payment options; repayment mortgages and interest-only mortgages. Currently, the most popular payment option is a repayment mortgage. This type of mortgage requires you to pay off the interest and a bit of your mortgage capital each month (the amount you actually borrowed). The repayments are calculated so that you are debt-free by the end of your mortgage term.

Council Tax

Overview

- Typical Frequency

Over 10 monthly instalments

- Amount

The amount you pay depends on your council tax band, what the local council charges, and any exceptions you may receive, e.g. a low-income discount

Your local authority collects council tax to pay for services they provide in your community, e.g. road maintenance, rubbish collection etc. Payments will vary depending on your property’s council tax band, the amount your local authority charges for each band, and whether you receive any exceptions. Council tax bands are public and can be checked on gov.uk.

Your bill will likely be paid over 10 monthly instalments, with a 2-month break at the end of the year.

Utility Bills – Gas, Electricity and Water

The phrase ‘utility bill’ is an umbrella term covering the costs associated with gas, electricity, and water.

Energy Bill (Gas and Electricity)

Overview

- Typical Frequency

Most pay monthly or quarterly

- Amount

Based on units consumed. Currently, someone who uses a typical amount of energy on a standard or default tariff will pay £1,971/yr on average.

Your energy usage plays a big factor in the costs of your bill. Therefore, your energy supplier will charge you based on your estimated usage, or if you have submitted a meter reading, it will be based on this. This charge is then paid periodically – in most cases, monthly or quarterly.

Having said this, your energy bill isn’t just the gas and electricity you use, they are made up of a number of costs. The largest contributor is wholesale costs. This is what your energy provider pays for the energy they give you and is one of the main reasons behind the recent hike in energy prices.

Water Bill

Overview

- Typical Frequency

Monthly or upon receiving your bill every six months

- Amount

According to Water UK (2021), the average water bill in England and Wales was forecast to be £408/yr for 2021/22.

Water bills can either be metered or unmetered. If you have a water meter, you are charged based on water usage, plus a fixed charge for the supplier’s service. If you don’t have a water meter, your bill will include a fixed charge and a set rate based upon the ‘rateable’ value of the home. The rateable value was set back in 1990 and will depend on factors such as the size of the house and the number of rooms.

Insurance

Overview

- Typical Frequency

Monthly or annually

- Amount

Average combined home insurance policy (building and contents insurance) for a house was £141.83 for Q4 2021, according to Money Supermarket.

Home insurance is broken down into building insurance and content insurance.

Building Insurance: Building insurance covers the structure of the building in case of any damage and repairs that need to take place. If you are using a mortgage, then it’s likely the mortgage provider will require you have adequate building insurance in place. In Q4 2021, average premiums for building only insurance policies were around £117/yr (Money Supermarket).

Contents Insurance: Contents insurance covers the items inside of the property in case they are damaged, lost or stolen. In Q4 2021, average premiums for contents only insurance policies were around £55/yr (Money Supermarket).

Broadband and Phone

Overview

- Typical Frequency

Monthly

- Amount

Depends on the type and speed chosen

The type and speed of broadband you require will largely dictate your monthly costs. The three common types of broadband in the UK are ADSL, cable and fibre. Each type of broadband offers various maximum speeds, with fibre typically being the fastest.

TV License

Overview

- Typical Frequency

Monthly, quarterly or annually

- Amount

Colour costs £159/yr

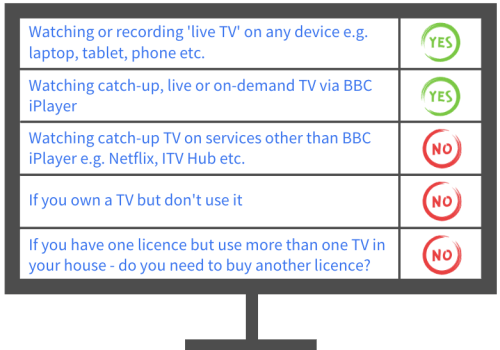

One of the main reasons for needing a TV licence is if you watch or record programmes as they’re being broadcast, i.e. live TV. This is the case whether you’re watching it on a TV or other device, such as a laptop or games console.

Although you’ll likely need a TV license, there are some scenarios when you won’t. We’ve broken down some typical situations below.

References

Santander. 2018. Owning a home is cheaper than renting in all areas of the UK | Santander UK. [online] Santander.co.uk. Available at: <https://www.santander.co.uk/about-santander/media-centre/press-releases/owning-a-home-is-cheaper-than-renting-in-all-areas-of-the-uk> [Accessed 15 May 2022].

Water UK. 2020. Average water and sewerage bills for England and Wales to fall by £17 in 2020/21. [online] Available at: <https://www.water.org.uk/news-item/average-water-and-sewerage-bills-for-england-and-wales-to-fall-by-17-in-2020-21/> [Accessed 15 May 2022].

MoneySuperMarket. 2022. Home Insurance – UK Price Index. [online] Available at: <https://www.moneysupermarket.com/ home-insurance/price-comparison-index/> [Accessed 15 May 2022].

Share This Article

Related Articles

Council Tax

Your local authority collects council tax to pay for services they provide in your community. Payment amounts will vary between properties.

Home Insurance

Home insurance protects your house if something were to go wrong. Home insurance is broken down into building insurance and contents insurance.

Mortgage Repayments Options

There are two main payment options to be aware of: repayment mortgages and interest-only mortgages.